Introduction

The year 2024 is shaping up to be a pivotal one for the US stock market. As investors brace for what could be a historic stock crash, it's crucial to understand the potential causes, impacts, and what steps to take to protect your investments. In this article, we'll delve into the factors that could lead to a stock market crash in 2024 and offer insights into how investors can navigate this uncertain landscape.

Possible Causes of the US Stock Crash 2024

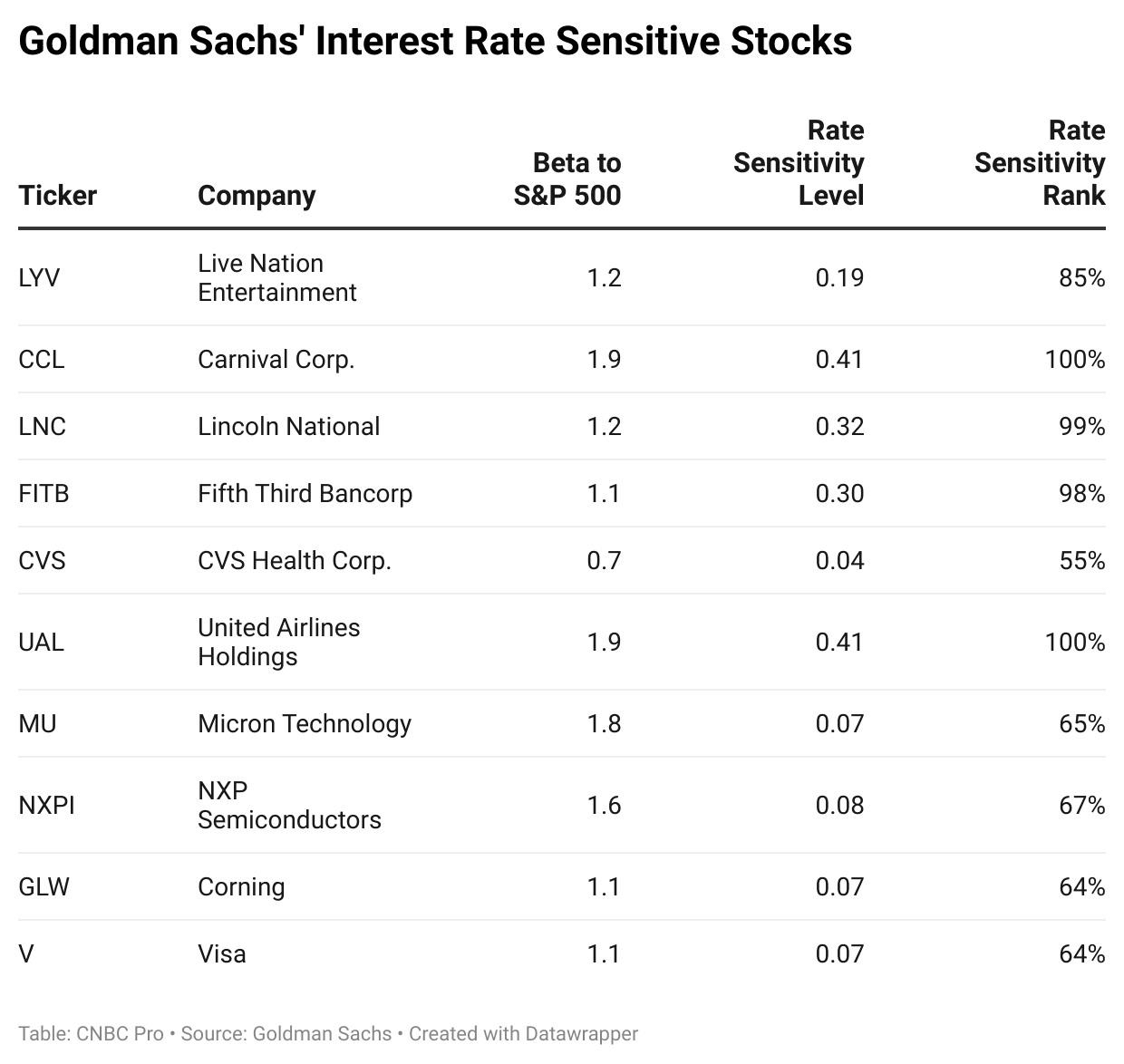

Economic Factors: One of the primary reasons for a potential stock market crash in 2024 could be economic factors such as inflation, rising interest rates, and a slowing economy. These factors can lead to a decrease in corporate earnings and investor confidence, resulting in a sell-off of stocks.

Geopolitical Tensions: Geopolitical tensions, such as trade wars or conflicts in key regions, can have a significant impact on the stock market. Investors often react to these uncertainties by selling off stocks, leading to a crash.

Tech Sector Volatility: The tech sector has been a major driver of the stock market's growth over the past decade. However, this sector is also prone to volatility, and a significant downturn in tech stocks could lead to a broader market crash.

Corporation Earnings: If corporations report disappointing earnings, it can lead to a loss of investor confidence and trigger a stock market crash. This is especially true if the earnings miss is widespread across various sectors.

Impact of the US Stock Crash 2024

A stock market crash in 2024 could have several implications, including:

Rising Unemployment: A crash could lead to job losses as companies cut costs to adapt to the new economic environment.

Decreased Consumer Spending: As people lose their jobs or face reduced income, consumer spending is likely to decrease, further impacting the economy.

Increased Borrowing Costs: A crash could lead to higher borrowing costs as lenders become more cautious about lending money.

What Investors Can Do

To protect your investments during a potential stock market crash in 2024, consider the following steps:

Diversify Your Portfolio: Diversifying your portfolio can help mitigate the risk of a stock market crash. Consider investing in different sectors, asset classes, and geographic regions.

Review Your Asset Allocation: Ensure your asset allocation aligns with your risk tolerance and investment goals. If you're risk-averse, you may want to increase your allocation to bonds or other income-generating assets.

Stay Informed: Keep up-to-date with economic news and market trends. This will help you make informed decisions about your investments.

Avoid Emotional Investing: Avoid making impulsive decisions based on fear or greed. Stick to your investment strategy and avoid reacting to short-term market movements.

Case Study: The 2020 Stock Market Crash

The 2020 stock market crash serves as a reminder of how quickly markets can change. The crash was primarily caused by the COVID-19 pandemic and the resulting economic downturn. Despite the downturn, the market quickly recovered as investors responded to stimulus measures and economic reopenings.

This case study highlights the importance of having a diversified portfolio and staying informed during turbulent times.

Conclusion

The potential for a stock market crash in 2024 is a concern for many investors. However, by understanding the potential causes and impacts of a crash, and taking appropriate steps to protect your investments, you can navigate this uncertain landscape with confidence. Remember to diversify your portfolio, review your asset allocation, stay informed, and avoid emotional investing.