Are you an investor in India looking to diversify your portfolio with US stocks? The allure of the American stock market is undeniable, offering a plethora of opportunities for growth and investment. However, navigating the waters of international trading can be daunting. This guide will provide you with everything you need to know about trading US stocks from India, ensuring a seamless and profitable experience.

Understanding the Basics

Before diving into the details, it's crucial to understand the basics of trading US stocks from India. Trading US stocks from India involves buying and selling shares of companies listed on US stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ, while you are physically located in India.

Choosing a Broker

The first step in trading US stocks from India is selecting a reliable and regulated broker. A broker acts as an intermediary between you and the stock market, facilitating your trades. When choosing a broker, consider the following factors:

- Regulation: Ensure the broker is regulated by a reputable financial authority, such as the Securities and Exchange Board of India (SEBI) or the Financial Industry Regulatory Authority (FINRA) in the US.

- Fees: Compare the fees charged by different brokers, including brokerage commissions, account maintenance fees, and other charges.

- Customer Support: Look for a broker that offers responsive and reliable customer support, both in terms of phone and email.

Some popular brokers for trading US stocks from India include Zerodha, Sharekhan, and Motilal Oswal.

Opening an Account

Once you've chosen a broker, the next step is to open a trading account. The process typically involves the following:

- Submission of Documents: Provide the necessary documents, such as your identity proof, address proof, and PAN card.

- KYC Compliance: Complete the Know Your Customer (KYC) process, which is a regulatory requirement for all investors.

- Linking Bank Account: Link your Indian bank account to the trading account to facilitate fund transfers.

Navigating the US Stock Market

Trading US stocks from India offers access to a wide range of companies across various sectors, including technology, healthcare, finance, and more. Here are some key aspects to consider when navigating the US stock market:

- Market Hours: The US stock market operates from 9:30 AM to 4:00 PM Eastern Time. Remember to adjust your trading hours accordingly.

- Currency Conversion: When trading US stocks from India, you'll be dealing with USD. Ensure you understand the implications of currency conversion and exchange rates.

- Research and Analysis: Conduct thorough research and analysis before making investment decisions. Utilize various tools and resources available online, including financial news websites, stock market analysis platforms, and broker-provided research.

Case Study: Investing in Apple Inc.

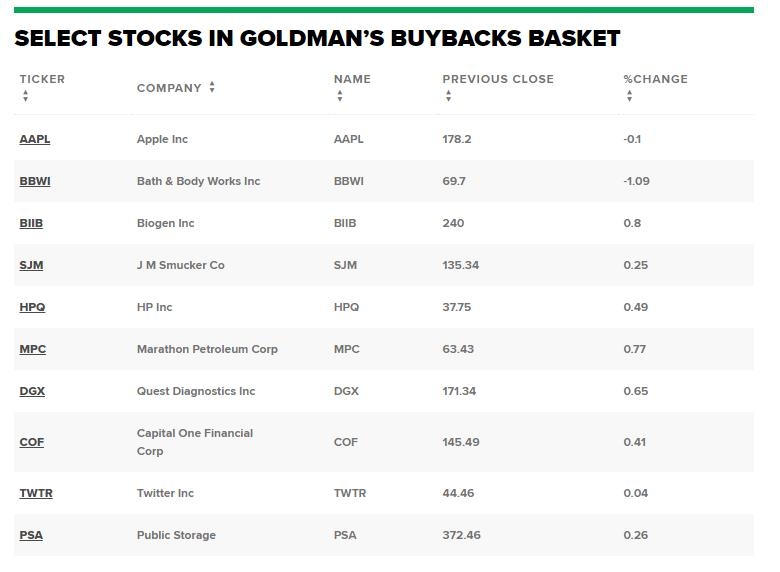

Let's consider a hypothetical scenario where an Indian investor decides to invest in Apple Inc. (AAPL), one of the most popular tech companies in the world.

- Research: The investor researches Apple's financials, market trends, and future growth prospects.

- Decision: Based on the research, the investor decides to purchase shares of Apple Inc.

- Execution: The investor logs into their trading account and places an order to buy AAPL shares.

- Monitoring: The investor monitors the performance of their investment and adjusts their strategy as needed.

Conclusion

Trading US stocks from India can be a rewarding experience, providing access to a diverse range of investment opportunities. By carefully selecting a broker, opening a trading account, and conducting thorough research, you can navigate the US stock market with confidence. Remember to stay informed and disciplined in your investment approach for long-term success.