In the ever-evolving global financial landscape, the question of whether Chinese investors are allowed to purchase US stocks has become increasingly relevant. This article delves into the intricacies of this matter, providing a comprehensive overview of the regulations and opportunities available to Chinese investors in the US stock market.

Understanding the Regulations

It is important to note that Chinese investors are indeed allowed to buy US stocks. However, the process is subject to certain regulations and restrictions. The China Securities Regulatory Commission (CSRC), the Chinese equivalent of the Securities and Exchange Commission (SEC) in the United States, plays a crucial role in overseeing these regulations.

Types of US Stocks Available to Chinese Investors

Chinese investors have access to a variety of US stocks, including:

- A-shares: These are stocks listed on the Shanghai and Shenzhen stock exchanges, primarily in Chinese yuan.

- B-shares: These are stocks listed on the Shanghai and Shenzhen stock exchanges, but denominated in US dollars or Hong Kong dollars.

- H-shares: These are stocks listed on the Hong Kong stock exchange, denominated in Hong Kong dollars.

- American Depositary Receipts (ADRs): These are US securities representing ownership in shares of a foreign company.

Regulatory Framework

The QFII (Qualified Foreign Institutional Investor) Program and the RQFII (RMB Qualified Foreign Institutional Investor) Program are two key regulatory frameworks that allow Chinese investors to invest in US stocks. These programs impose certain restrictions and requirements on investors, including:

- Minimum investment amount: Investors must meet a minimum investment threshold to participate in these programs.

- Investment limits: There are limits on the amount of money that can be invested in certain sectors or individual stocks.

- Reporting requirements: Investors must comply with reporting requirements to the CSRC.

Case Studies

Let's consider a few examples to illustrate how Chinese investors can buy US stocks:

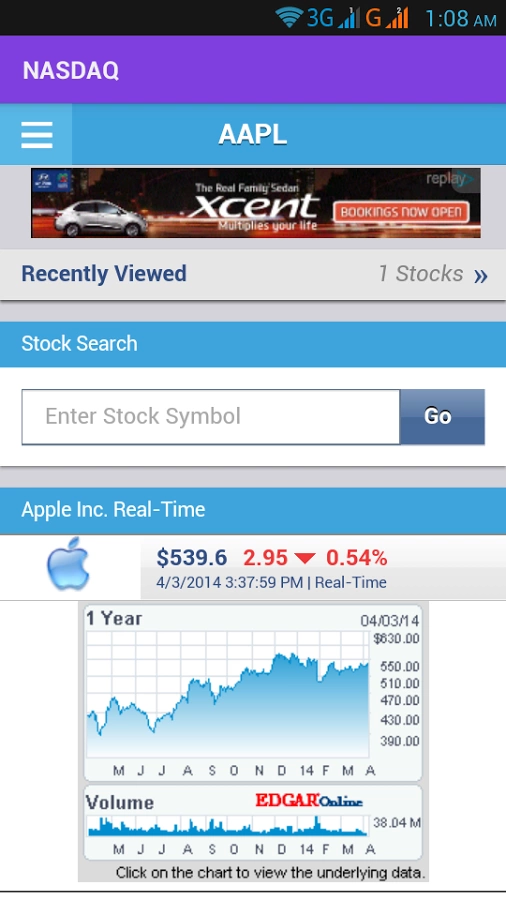

- Example 1: A Chinese investor, through the QFII program, invests in a US tech company listed on the NASDAQ. The investor must comply with the program's regulations, including the minimum investment amount and reporting requirements.

- Example 2: A Chinese investor purchases ADRs of a US company listed on the New York Stock Exchange. The investor can trade these ADRs on the Shanghai or Shenzhen stock exchanges, provided they have the necessary qualifications and meet the regulatory requirements.

Conclusion

In conclusion, Chinese investors are allowed to buy US stocks, but they must navigate a complex regulatory framework. By understanding the regulations and utilizing the appropriate programs, Chinese investors can access a wide range of investment opportunities in the US stock market.