As the holiday season approaches, investors have reason to celebrate with the major US stock indexes closing higher ahead of Christmas. This surge in the market has raised optimism and generated a positive sentiment among investors. Let's delve into the factors contributing to this upward trend and how it might impact the economy in the coming year.

Market Surge: A Sign of Economic Recovery?

The rise in the major US stock indexes, including the S&P 500, NASDAQ, and Dow Jones, can be attributed to several factors. Firstly, the Federal Reserve's recent decision to pause its rate hikes has provided relief to investors. This move has been seen as a sign of the Fed's willingness to support economic growth and stability.

Secondly, the strong performance of technology stocks has been a major driver of the overall market's upward trend. Companies like Apple, Microsoft, and Amazon have reported strong earnings, boosting investor confidence in the sector.

Consumer Sentiment: A Bright Spot in the Economy

Another factor contributing to the market's rise is the strong consumer sentiment. With the economic recovery gaining momentum, consumers are spending more, driving demand for goods and services. This increase in consumer spending has had a positive impact on the retail sector, which has been a significant contributor to the overall market's growth.

Impact on the Economy

The rise in the major US stock indexes ahead of Christmas could have several positive impacts on the economy. Firstly, it could lead to increased business investment as companies see higher returns on their investments. This, in turn, could create more jobs and drive economic growth.

Secondly, the strong performance of the stock market could lead to higher wealth levels among investors, which could stimulate spending. As investors see their portfolios grow, they are more likely to spend on goods and services, further boosting the economy.

Case Study: Apple's Impact on the Market

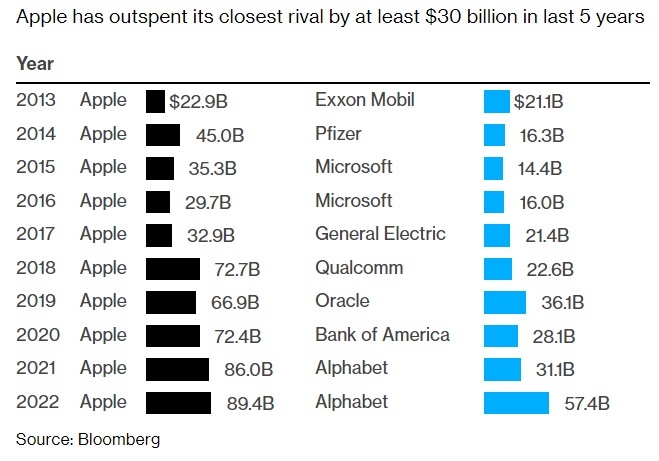

A notable case study is Apple's strong performance in recent quarters. The company has been able to leverage its dominant position in the technology sector, reporting record-breaking earnings and driving the overall market's growth. Apple's success serves as a testament to the power of strong corporate performance in driving market trends.

Conclusion

The major US stock indexes closing higher ahead of Christmas is a sign of optimism and economic recovery. With strong consumer sentiment and the support of the Federal Reserve, the market is poised for continued growth in the coming year. As investors and businesses alike benefit from this upward trend, the overall economy stands to gain.

Key Takeaways:

- Market Surge: The major US stock indexes have closed higher ahead of Christmas, driven by factors such as the Fed's decision to pause rate hikes and strong performance of technology stocks.

- Consumer Sentiment: The strong consumer sentiment, supported by the economic recovery, has had a positive impact on the retail sector.

- Economic Impact: The rise in the stock market could lead to increased business investment and higher wealth levels among investors, stimulating spending and economic growth.