The Dow Jones Industrial Average, often simply referred to as the "Dow," is one of the most widely followed stock market indices in the United States. Its performance reflects the overall health of the American economy and provides investors with a quick snapshot of the market. However, the recent decline in the Dow has left many investors questioning how much it has dropped and what it means for their investments. This article delves into the current state of the Dow, its recent decline, and the factors contributing to it.

The Current State of the Dow Jones

As of the latest data, the Dow Jones has experienced a significant decline. The index has dropped by a substantial amount, reaching a level that has raised concerns among investors. This decline is a result of various factors, including economic uncertainties, geopolitical tensions, and market corrections.

Economic Uncertainties

One of the primary reasons for the Dow's decline is the ongoing economic uncertainties. The global economy is facing challenges such as trade wars, slowing growth in major economies, and rising inflation. These uncertainties have led to volatility in the stock market, causing the Dow to drop significantly.

Geopolitical Tensions

Geopolitical tensions have also played a significant role in the Dow's decline. The ongoing conflict in the Middle East, tensions between the United States and China, and other geopolitical issues have created an environment of uncertainty and risk, which has negatively impacted the stock market.

Market Corrections

Another factor contributing to the Dow's decline is market corrections. The stock market has been on a steady uptrend for the past few years, leading to a buildup of speculative positions. As a result, the market has become due for a correction, and the recent decline in the Dow is a part of this correction process.

Impact on Investors

The decline in the Dow has had a significant impact on investors. Many investors have seen their portfolios decline in value, leading to concerns about their financial futures. However, it is essential to understand that market volatility is a normal part of investing, and the decline in the Dow does not necessarily indicate a long-term bear market.

Historical Perspective

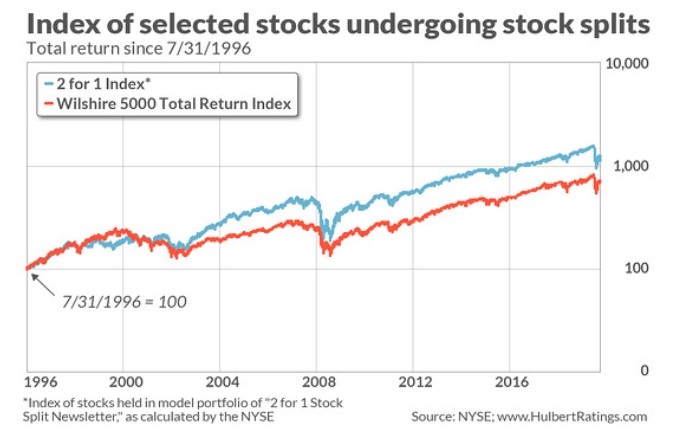

To put the current Dow decline into perspective, it is essential to look at historical data. The Dow has experienced numerous declines in the past, but it has always recovered and continued to grow. This historical perspective can provide investors with the confidence to stay invested and ride out the current market volatility.

Case Studies

Several case studies have shown that investors who stayed invested during market downturns have ultimately benefited. For example, during the financial crisis of 2008, the Dow dropped by more than 50%. However, those who stayed invested and rode out the downturn saw their portfolios recover and grow over time.

Conclusion

In conclusion, the Dow Jones has experienced a significant decline, driven by economic uncertainties, geopolitical tensions, and market corrections. While this decline has raised concerns among investors, it is important to maintain a long-term perspective and stay invested. Historical data and case studies have shown that the market has always recovered from downturns, and investors who stay invested ultimately benefit.