In today's interconnected world, financial markets play a pivotal role in the global economy. From individual investors to large corporations, understanding the intricacies of financial markets is crucial for making informed decisions. This article delves into the essentials of financial markets, providing an in-depth understanding of their functions, benefits, and risks.

Understanding Financial Markets

Financial markets are platforms where buyers and sellers trade financial assets such as stocks, bonds, currencies, and commodities. These markets facilitate the flow of capital, enabling businesses and governments to raise funds for expansion and investment. Financial markets are typically categorized into three main types: debt markets, equity markets, and derivative markets.

Debt Markets

Debt markets involve the issuance and trading of debt securities, such as bonds and treasuries. These instruments represent a loan from the buyer to the issuer, with the promise of repayment and interest over a specified period. Debt markets provide a stable source of funding for governments and corporations, allowing them to finance long-term projects and operations.

Equity Markets

Equity markets are where shares of publicly-traded companies are bought and sold. Investors purchase shares, becoming partial owners of the company, and can benefit from the company's growth and profitability. Equity markets provide a vital source of capital for businesses, enabling them to expand, innovate, and create jobs.

Derivative Markets

Derivative markets involve the trading of financial contracts based on an underlying asset, such as a stock, bond, or commodity. Derivatives are used for hedging risk, speculation, and arbitrage. Common types of derivatives include options, futures, and swaps.

Benefits of Financial Markets

Financial markets offer numerous benefits to participants and the economy as a whole. Here are some key advantages:

- Capital Formation: Financial markets enable businesses and governments to raise capital for investment and expansion.

- Risk Management: Derivative markets provide tools for managing and mitigating risk.

- Efficient Allocation of Resources: Financial markets ensure that capital is allocated to its most productive uses.

- Economic Growth: By facilitating investment and innovation, financial markets contribute to economic growth and development.

Risks in Financial Markets

While financial markets offer numerous benefits, they also come with inherent risks. Some of the key risks include:

- Market Volatility: Financial markets can be highly volatile, leading to significant price fluctuations and potential losses.

- Credit Risk: Debt securities carry the risk of default, where the issuer may fail to meet its payment obligations.

- Liquidity Risk: Some financial instruments may be difficult to sell at desired prices, leading to liquidity issues.

Case Studies

To illustrate the impact of financial markets, let's consider a few case studies:

- Apple's Stock Market Performance: Since its initial public offering (IPO) in 1980, Apple's stock has seen significant growth, reflecting the company's innovation and success in the tech industry.

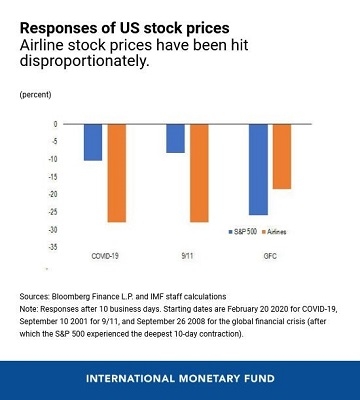

- The 2008 Financial Crisis: The 2008 financial crisis highlighted the risks associated with financial markets, particularly in the debt and equity sectors. The crisis led to widespread market turmoil and a global economic downturn.

Conclusion

Understanding financial markets is essential for making informed decisions and navigating the complexities of the global economy. By familiarizing oneself with the functions, benefits, and risks of financial markets, individuals and organizations can leverage their power to achieve their financial goals.