In today's globalized economy, the stock markets of Japan and the United States play a significant role in shaping financial trends and investor confidence. This article delves into a comprehensive comparison of the two markets, highlighting their unique characteristics, performance, and future prospects.

Market Size and Composition

The Japan stock market, often referred to as the Tokyo Stock Exchange (TSE), is the third-largest in the world by market capitalization. It is home to many of Japan's largest companies, including Toyota, Sony, and Honda. The TSE is known for its diversity, with a significant presence of both manufacturing and non-manufacturing sectors.

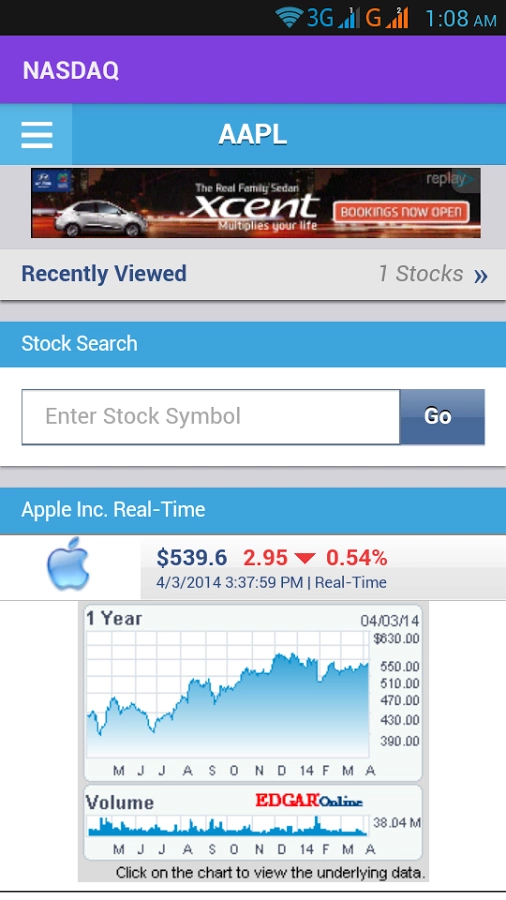

On the other hand, the US stock market is the largest in the world, with the New York Stock Exchange (NYSE) and the NASDAQ being the most prominent exchanges. The US market is characterized by a broad range of sectors, including technology, healthcare, finance, and consumer goods. Companies like Apple, Microsoft, and Amazon are some of the major players in the US stock market.

Performance and Trends

Historically, the US stock market has outperformed the Japanese market, primarily due to higher economic growth rates and technological advancements. However, in recent years, the Japanese market has shown remarkable resilience, with companies adapting to the evolving global economy.

One of the key trends in the Japanese stock market is the rise of "Abenomics," a set of economic policies implemented by Prime Minister Shinzo Abe. These policies, including monetary stimulus and fiscal spending, have helped boost the market's performance.

In the US, the stock market has experienced significant growth, driven by factors such as low interest rates, strong corporate earnings, and technological innovation. The NASDAQ, in particular, has seen rapid growth, with many tech companies going public and attracting substantial investor interest.

Investment Strategies

Investors looking to invest in either market should consider several factors, including their risk tolerance, investment horizon, and market knowledge. Here are some investment strategies for both markets:

Japan Stock Market:

- Value Investing: The Japanese market offers many undervalued stocks, making value investing a viable strategy.

- Dividend Investing: Japanese companies are known for their strong dividend policies, making dividend investing a popular choice.

- Sector Focus: Focus on sectors such as healthcare, consumer goods, and technology, which have shown strong growth in recent years.

US Stock Market:

- Growth Investing: The US market offers many growth stocks, making growth investing a popular choice.

- Technology Stocks: Focus on tech companies that are leading the innovation and growth in the market.

- Sector Rotation: Rotate between sectors based on market trends and economic conditions.

Conclusion

In conclusion, the Japan and US stock markets offer unique opportunities for investors. While the US market has traditionally outperformed, the Japanese market has shown resilience and potential for growth. Investors should consider their investment goals and risk tolerance when choosing between these markets.