Are you looking for the best US stock broker to manage your investments? With the vast array of options available, it can be overwhelming to make the right choice. This article will delve into the top stock brokers in the US, highlighting their key features, fees, and benefits. Whether you're a beginner or an experienced investor, these picks will help you find the best fit for your investment needs.

1. Fidelity Investments

Fidelity is renowned for its comprehensive services and user-friendly platform. It offers a wide range of investment options, including stocks, bonds, ETFs, and mutual funds. Fidelity's research tools and educational resources make it an excellent choice for investors of all levels.

Key Features:

- Low fees and transparent pricing

- Access to over 100,000 mutual funds and ETFs

- Robust research tools and educational resources

- Mobile app with advanced features

2. Charles Schwab

Charles Schwab is another top choice for US investors. It offers a user-friendly platform with a wide selection of investment options, including stocks, bonds, ETFs, and mutual funds. Schwab is also known for its excellent customer service and educational resources.

Key Features:

- No account minimums

- Low fees and transparent pricing

- Access to over 4,000 mutual funds and ETFs

- Mobile app with advanced features

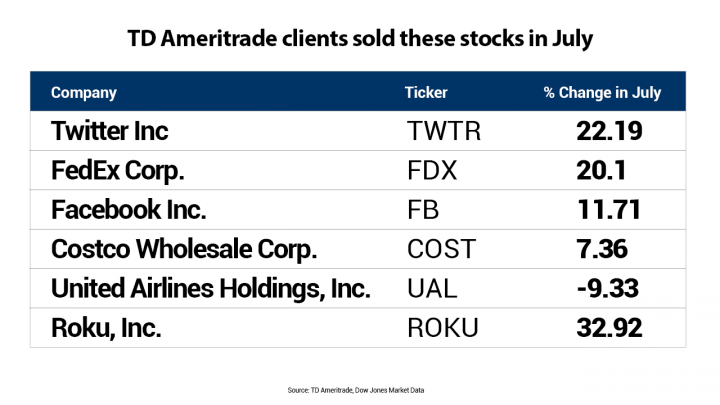

3. TD Ameritrade

TD Ameritrade is a popular choice among active traders due to its powerful trading tools and research capabilities. It offers a wide range of investment options, including stocks, bonds, ETFs, and mutual funds. TD Ameritrade also provides educational resources and a robust mobile app.

Key Features:

- Low fees and transparent pricing

- Access to over 3,000 mutual funds and ETFs

- Advanced trading tools and research capabilities

- Mobile app with advanced features

4. E*TRADE

E*TRADE is a well-rounded platform that caters to both beginners and experienced investors. It offers a wide selection of investment options, including stocks, bonds, ETFs, and mutual funds. E*TRADE is known for its excellent customer service and educational resources.

Key Features:

- Low fees and transparent pricing

- Access to over 4,000 mutual funds and ETFs

- Robust research tools and educational resources

- Mobile app with advanced features

5. Robinhood

Robinhood has gained popularity among younger investors due to its user-friendly app and low fees. While it primarily focuses on stocks, ETFs, and options, Robinhood is an excellent choice for those looking to diversify their portfolio on a budget.

Key Features:

- Zero commission trading

- No account minimums

- User-friendly app and platform

- Access to over 3,000 ETFs

In conclusion, selecting the best US stock broker depends on your investment goals, experience level, and preferences. Whether you're looking for comprehensive services, low fees, or advanced trading tools, these top picks can help you find the right fit for your needs. Remember to do thorough research and compare fees, services, and customer reviews before making your decision.