Investing in the US stock market has long been a dream for many international investors, including those from Vietnam. The allure of the American stock market, known for its robustness and diverse range of companies, is undeniable. But can Vietnamese investors actually participate in this market? The answer is a resounding yes, and this guide will walk you through the process, including the necessary steps, potential risks, and benefits.

Understanding the Basics

To begin with, it's important to understand that Vietnamese investors have several options when it comes to investing in US stocks. The most common methods include:

- Brokerage Accounts: You can open a brokerage account with a US-based firm and purchase stocks directly.

- Through a Foreign Exchange Platform: Some platforms allow international investors to trade US stocks without a brokerage account.

- Investment Funds: Participating in mutual funds or ETFs that invest in US stocks is another option.

Opening a Brokerage Account

Step 1: Research and choose a reputable US brokerage firm. Look for one that offers services tailored to international investors. Step 2: Complete the account opening process, which typically involves filling out an application, providing identification, and verifying your address. Step 3: Fund your account. You can usually do this by wiring money from your Vietnamese bank account or through an international money transfer service.

Understanding Risks and Rewards

Investing in US stocks offers several benefits, including:

- Market Diversity: Access to a wide range of industries and sectors not available in Vietnam.

- Potential for High Returns: Historically, the US stock market has offered higher returns than many other markets.

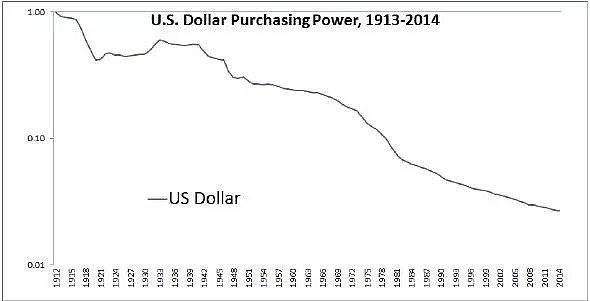

- Currency Exposure: Investing in US stocks can provide exposure to the US dollar, which may be a good hedge against your local currency.

However, there are also risks to consider:

- Currency Risk: Fluctuations in the exchange rate can impact your returns.

- Market Volatility: The US stock market can be volatile, leading to significant gains or losses.

- Regulatory Differences: Understanding and complying with US regulations is essential.

Case Studies

Let's consider a hypothetical case:

Nguyen Tran, a Vietnamese investor, decides to invest

This example illustrates the potential for growth but also highlights the importance of considering currency risk.

Conclusion

Investing in US stocks can be a valuable addition to a Vietnamese investor's portfolio. By understanding the process, potential risks, and rewards, you can make informed decisions. Whether you choose to open a brokerage account, trade through a foreign exchange platform, or invest in funds, the key is to do thorough research and consider your investment goals and risk tolerance.