The US stock market has been a topic of intense discussion and concern among investors and analysts alike. With recent volatility, many are asking: is the US stock market still crashing? This article aims to provide a comprehensive analysis of the current state of the US stock market, highlighting key factors and trends that could influence its future.

Understanding Market Volatility

Market volatility is a natural part of the stock market's ebb and flow. It is characterized by significant price fluctuations over a short period of time. Volatility can be caused by various factors, including economic data, political events, and changes in investor sentiment.

Recent Market Trends

In the past few months, the US stock market has experienced considerable volatility. Many investors are concerned about the possibility of a crash, especially in the wake of the COVID-19 pandemic and the subsequent economic downturn.

Key Factors Influencing the Market

Several key factors have contributed to the current state of the US stock market:

- COVID-19 Pandemic: The pandemic has had a profound impact on the global economy, leading to widespread volatility in the stock market.

- Economic Data: The release of economic data, such as unemployment rates and GDP growth, can cause significant movements in the market.

- Political Events: Events such as elections and policy changes can also influence market sentiment.

Analysis of Key Stock Indices

Let's take a look at some of the key stock indices to better understand the current state of the US stock market:

- S&P 500: The S&P 500 is a widely followed index that includes the top 500 companies in the United States. It has experienced significant volatility in recent months, but it has also seen strong recoveries in some periods.

- Dow Jones Industrial Average: The Dow Jones Industrial Average tracks the performance of 30 large companies in the United States. It has also seen significant volatility, but it has also recovered from previous lows.

- NASDAQ Composite: The NASDAQ Composite includes all companies listed on the NASDAQ stock exchange. It has been particularly volatile, reflecting the rapid growth and decline of technology stocks.

Investor Sentiment and Market Trends

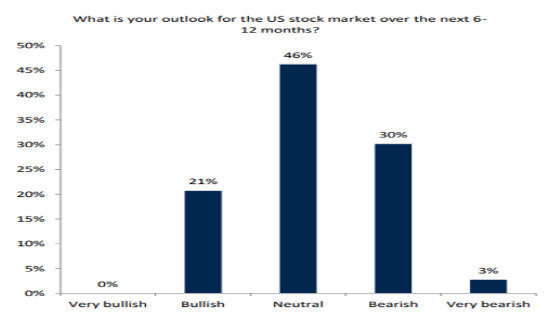

Investor sentiment has played a significant role in the current state of the US stock market. Many investors are looking for safe havens in the face of volatility and uncertainty. This has led to a surge in demand for bond yields and dividend-paying stocks.

Conclusion

In conclusion, while the US stock market has experienced significant volatility in recent months, it is difficult to say definitively whether it is still crashing. Factors such as the COVID-19 pandemic, economic data, and investor sentiment all play a role in determining the market's direction. As always, investors should carefully consider their investment strategies and consult with financial professionals before making any significant decisions.