In the ever-evolving financial landscape, the US banking sector plays a pivotal role in the global economy. This article delves into the current state of stocks in the US banking industry and explores the future prospects, highlighting key trends and opportunities.

Understanding the US Banking Sector

The US banking sector is composed of various types of institutions, including commercial banks, savings banks, credit unions, and investment banks. These institutions offer a wide range of services, including personal and business banking, investment services, and underwriting of securities.

Current State of Stocks in the US Banking Industry

1. Strong Market Performance

Over the past few years, the US banking industry has demonstrated resilience and strength, with stocks in the sector performing well. Factors contributing to this include:

- Economic Growth: The US economy has experienced steady growth, leading to increased demand for banking services.

- Interest Rates: The Federal Reserve has raised interest rates gradually, providing a favorable environment for banks to earn higher returns on loans.

- Regulatory Environment: The implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act has helped to stabilize the financial system and reduce the risk of another financial crisis.

2. Increased Mergers and Acquisitions

The US banking industry has witnessed a surge in mergers and acquisitions, with banks seeking to expand their market share and enhance their competitive position. This trend is expected to continue, as banks look to achieve economies of scale and improve operational efficiency.

3. Technological Advancements

Technological advancements, such as mobile banking and digital payments, have transformed the banking industry. These innovations have not only improved customer experience but also reduced costs for banks.

Future Prospects for Stocks in the US Banking Industry

1. Continued Economic Growth

The US economy is expected to continue growing, providing a supportive environment for the banking industry. This growth is likely to drive demand for banking services and support the performance of stocks in the sector.

2. Regulatory Changes

Regulatory changes, such as the potential rollback of certain provisions of the Dodd-Frank Act, could impact the US banking industry. It is crucial for investors to stay informed about these changes and their potential implications.

3. Technological Disruption

Technological disruption, particularly from fintech companies, poses a significant threat to traditional banks. To remain competitive, banks will need to invest in technology and innovation.

Key Takeaways

The US banking industry has demonstrated resilience and strength, with stocks in the sector performing well. However, investors should remain vigilant about potential risks, such as regulatory changes and technological disruption. By staying informed and making informed decisions, investors can capitalize on the opportunities presented by the US banking industry.

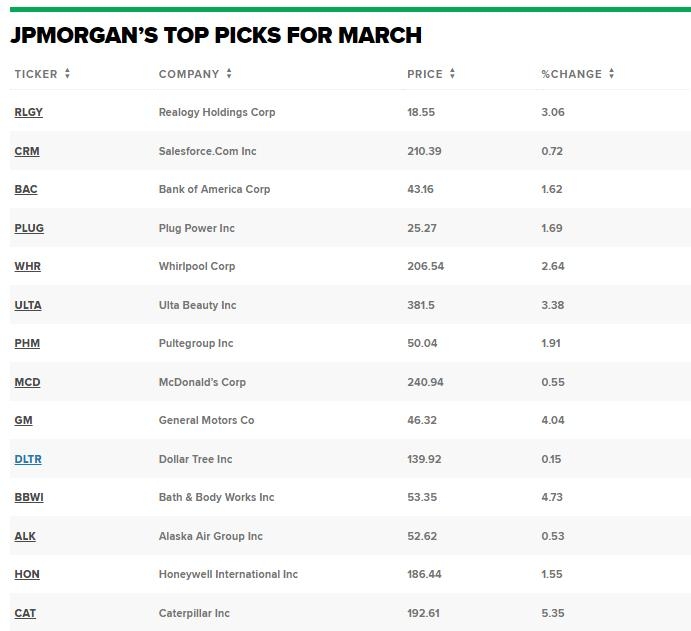

Case Study: JPMorgan Chase

JPMorgan Chase, one of the largest banks in the US, has been a leader in the industry. The bank has successfully navigated the financial crisis and has continued to grow its market share. Its focus on innovation, such as the development of its mobile banking app, has helped the bank to remain competitive.

In conclusion, the US banking industry offers a promising outlook for investors. By understanding the current state and future prospects of stocks in the industry, investors can make informed decisions and capitalize on the opportunities presented.